Knowing When it’s Time to File a Bankruptcy or Consumer Proposal

Life doesn’t always go according to plan. Unexpected life occurrences can happen to anyone and are simply out of your control, such as illness/disability, divorce, job loss etc. If you experience any of these, they can drastically affect your financial health. In...

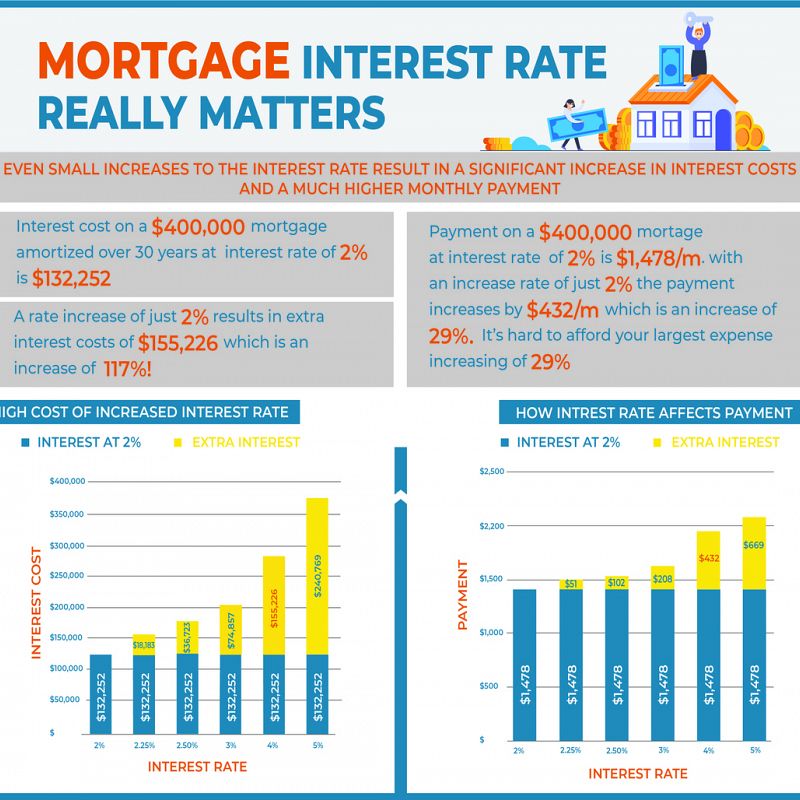

What does Interest Rate increase mean to me?

The Bank of Canada has implemented rapid interest rate hikes, as the rate has increased 2.25% in just the last few months. They have also indicated we should expect further interest rate hikes in the coming year. What does that mean to Canadians that have debt? For...

Never just pay minimum payments on your credit card

Credit cards are designed to extract the maximum amount of interest charges from you. The interest rates are typically high and they encourage you to stay in debt for as long as possible by requiring only a small minimum payment each month. This minimum payment is...

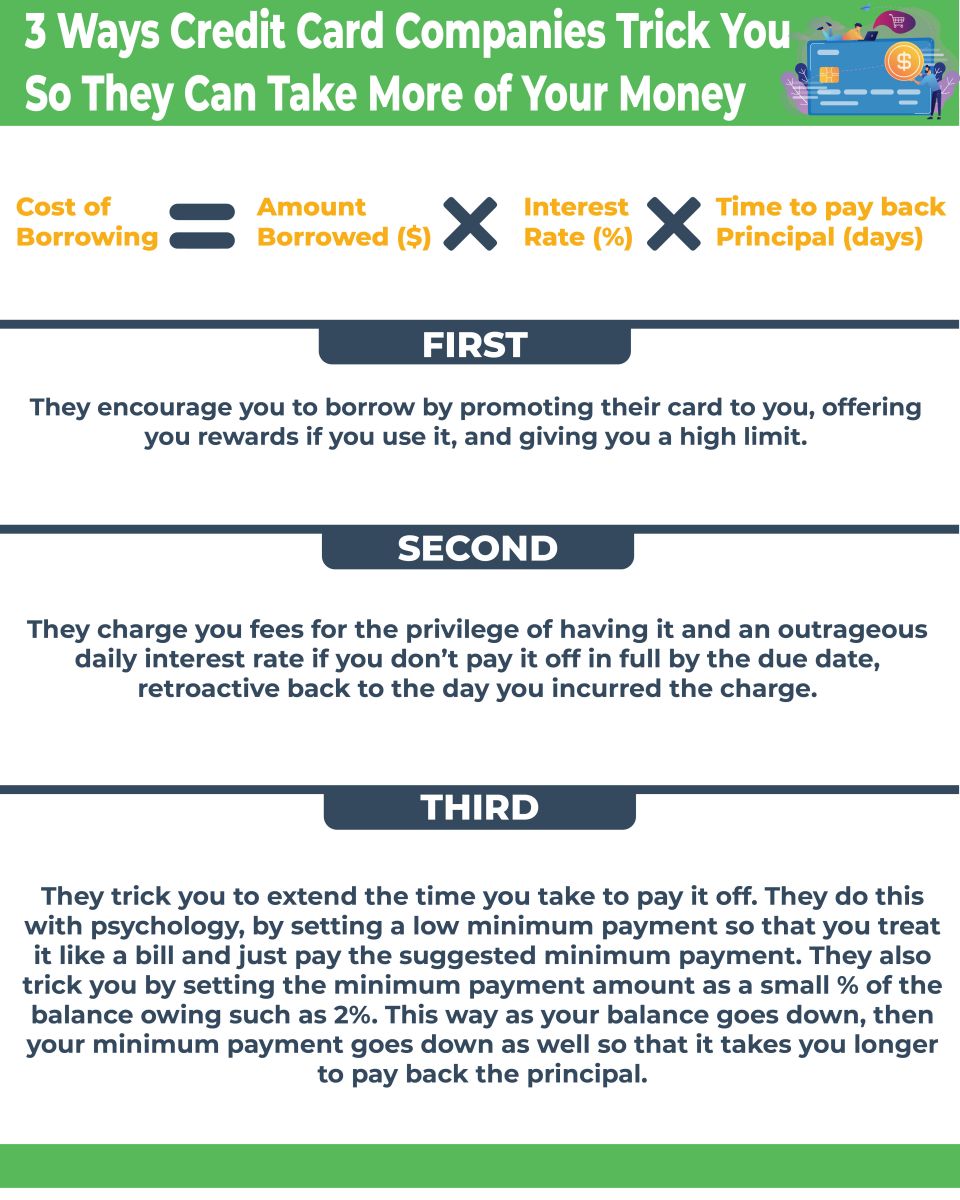

3 ways credit card companies trick you

Credit Card companies are excellent at tricking you to take more of your money: First they push cards on you and encourage you to use them. Second they find many ways to charge you fees and of course carry a very high interest rate. Third they encourage you to borrow...

Personal Finance Pillar # 2 – BORROWING – What is Good Debt?

Debt is not inherently bad or good. There are however good reasons for incurring debt and bad reasons for incurring debt. Your financial goal should not be to grow the biggest pile of cash possible, but rather to get the most enjoyment out of your money, to maximize...

Personal Finance Pillar # 3 – INVESTING – 10 Steps the Wealthy Follow to Get Rich

You can make more money and grow your wealth by working harder. Generally, the more hours you work, the more money you will make. However, putting in more hours, burning the midnight oil, putting your nose to the grindstone, these all don’t sound like much fun. There...

Personal Finance Pillar # 4 – RISK MANAGEMENT – Be Insurance Smart to Manage Life’s Risks

Stuff happens. I know you don’t think it will happen to you, but it can. I have consulted hundreds of people who were hit by a totally unexpected peril that they never saw coming. Their house burnt down. They become disabled. They get sued and liable for a huge loss....

Personal Finance Pillar # 1 – SPENDING – Oops I Did It Again!

As well as being a Britney Spears song, this is a common phrase I hear from clients who repeatedly fail to reduce their monthly spending to meet their financial goals. The reality is that despite one’s best intentions it can be difficult to change your habits and not...